New Structure and Delivery of the Foundation 3

1. What's Going On: Updates from Foundation Benefits, insurance industry news, and broader business impacts.

2. Something Smart: Insights or quotes that are insightful and thought-provoking, not necessarily related to insurance.

3. About Benefits: Focused on HR compliance, employment processes, and general benefits information.

Foundation 3 will be shared each Thursdays at 10 AM.

5.9.24

Service team Highlight:

These ladies are awesome.

HB 2002:

Paying cash price for deductible costs

Applies to PPO & EPO plans

Noncompete Clauses:

Non competes will be eliminated in September 2024.

Some employees & industries are excluded.

5.2.24

Key focus on labor issues in HR:

Challenge of acquiring qualified candidates.

Workforce demographics shifting.

Challenges of multi-generation.

Suggesting a solution:

Retraining current employees.

Resource to help: Skills gap analysis checklist.

4.25.24

Click on the picture below to follow the linked pages.

Texicare

New medical carrier entering the market May 1, 2024.

Planning to be competitive in the Panhandle and West Texas; other regions to be evaluated.

Book recommendation: Chasing Failure

Focusing on learning from failures and personal growth.

Recommend the Audiobook. The Author reads the book and it really help resonate.

Considering Payroll Integration?

We partner with several providers.

Potential cost savings when using our partnerships.

Client Questions:

We frequently receive inquiries about many different topics.

We encourage your questions and are promised thorough research and support to determine the suitability.

A Funny Story:

Story about a young employee's perception of age while discussing life insurance.

Communicating with Employees:

The importance of effectively communicating with employees about both benefits and the overall business.

Attachment on website that provides tips on keeping employees engaged and well-informed.

4.18.24

4.11.24

It’s great having old clients

Value of long-term client relationships.

Importance of deeply understanding and anticipating client needs.

New initiative to answer client questions on the website,

Inspired by the book "They Ask, You Answer."

Add you question to the comments of the video.

HR Checklists

Link to the best compliance checklist of 2023.

Medicare coordination of benefits:

Based on age:

If in a group under 20, Medicare is primary; over 20, Medicare is secondary.

Based on disability:

Over 100 employees, group plan is primary; under 100, Medicare is primary.

4.4.24

Adding , Subtracting, Multiplying or Dividing

Importance of contributing positively (adding or multiplying) in personal and professional contexts.

Mental health parity in health plans:

Must be included in all health plans.

Benefits cannot be more restrictive than other benefits.

Treatment limits must comply with statute requirements.

3.28.24

HR Challenges in Small Businesses:

Individuals unexpectedly assume HR roles.

Partnered with an HR consulting firm

Aid in compliance.

Handling HR queries.

Quotables:

"You can't depend on the undependable.”

Click on Steve below for HR recording resource

Social Media Risks:

Recorded interactions pose potential risks.

Train personnel involved in terminations

Establishing policies against recording HR interactions.

Document performance issues.

3.21.24

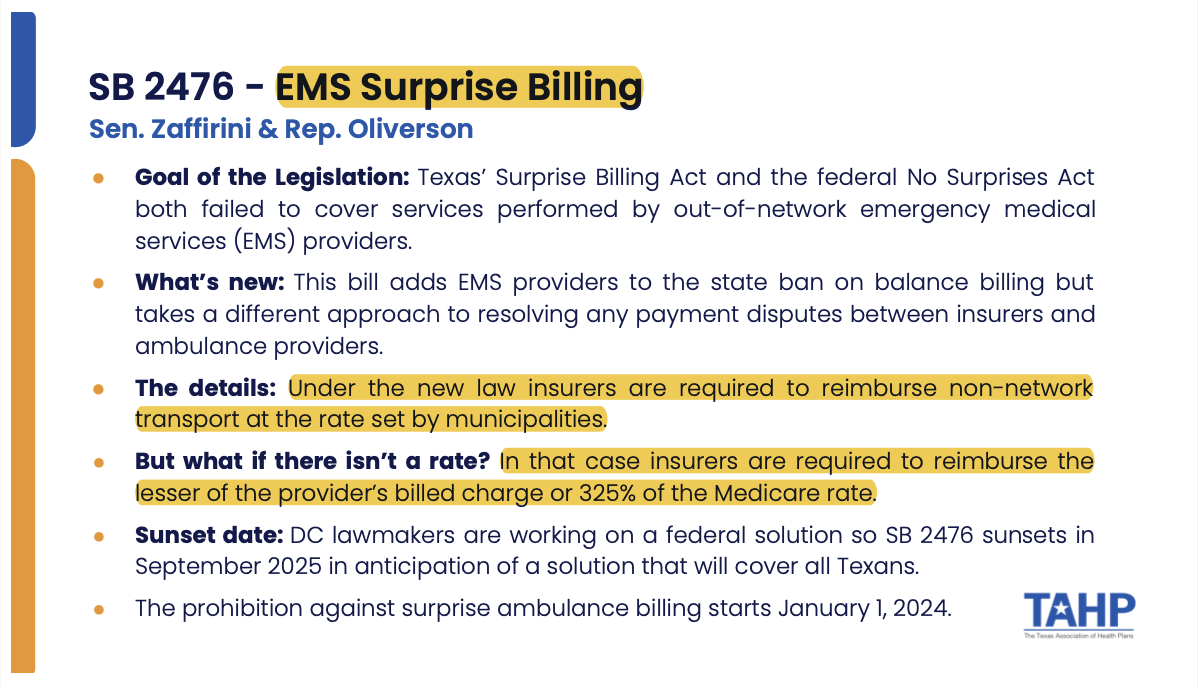

Ambulance No Surprise Billing:

Protects against unexpected high costs for ambulance services.

Costs are set by local rates or capped at 325% of Medicare allowable amounts for non-network transportation.

Employee Investment:

Focus on employee development with bi-weekly coaching.

Aim to align personal goals with your business goals.

Advocates for training to improve retention and performance.

Cafeteria Plan Compliance (Section 125):

Necessary for pre-tax medical benefits; requires annually.

Compliance includes maintaining current documentation.

3.14.24

Senate Bill 490 Implementation:

Requires hospitals to provide itemized bills before pursuing medical debt collection, addressing medical debt bankruptcy and promoting price transparency.

"A Road Less Stupid" Insights:

Highly recommended book offering valuable business advice through short, topic-diverse chapters, practical examples, and critical thinking questions.

COBRA vs. State Continuation:

The threshold is 20 employees; businesses with 20+ must offer COBRA, while those with 19 or fewer offer state continuation.

Special Note for Self-Insured/Level Funded Plans: If under 20 employees, no obligation to offer state continuation; over 20 must provide COBRA.

Attended SHRM meeting; discussed Independent Contractors:

DOL's test for independent contractors includes five traditional and two new questions.

Why recommendation to consult an attorney over a CPA for DOL matters.

Reading "Atomic Habits"; key takeaway:

Immediate gratification should be scrutinized for alignment with long-term goals.

Long-term benefits typically indicate better outcomes for business.

3.7.24

Discussion with an HR professional from a large company:

Importance of choosing the right benefits, not just any benefits.

Toolkits for employee retention and recruitment provided on website.

2.29.24

What’s going on?: Highlights of House Bill 2002

Effective from January 1, allowing employees to request cash prices for certain medical procedures

Cash prices can be applied towards PPO or EPO plan deductibles, potentially halving the cost

Something Smart: Know thy self.

Emphasized the importance of knowing your strengths and focusing on them

Foundation Benefits focuses solely on payroll deduction services, avoiding areas like Medicare and individual policies

Benefits Take Away: Importance of compliance and tools provided

2024 compliance calendar will be available on their website to guide on deadlines and actions

Designed as a comprehensive resource for maintaining compliance

November 9, 2023

-

I-9 Requirement Changes

New form is required Nov. 1.

An I-9 is required for all new hires.

Follow link for new I-9 form.

-

New 1094 &1095 Info

No substantial changes to form.

New electronic filing threshold.

What are the required filing dates?

-

ERISA Fiduciary Responsibility

No substantial changes to form.

New electronic filing threshold.

What are the required filing dates?

October 26, 2023

-

Gag Clause Attestation

Affects all major medical plans.

Who’s is responsible for this?

How do you file?

-

FMLA: Mental health FAQs

How does mental health work with FMLA?

See several scenarios.

What steps can employers take?

-

ACA Compliance: 2024 Checklist

What are the limits for plans in 2024?

ALE considerations.

What forms need tom be filed?

October 12, 2023

-

Medicare Notices Due Oct 15th

Follow this link to get a template.

All employees should be notified.

How are they required to be notified?

-

Allowing Employees Time to Vote

What are the rules for your state?

Are you required to pay employees while they vote?

What if they are off duty during voting hours?

-

Increased HIPAA Violations Penalties

What are the common violations?

How are these penalties calculated?

Did you know penalties are adjusted to inflation?

Medical Part D Requirements Due October 15th

A main focus for Foundation Benefits is making sure that compliance is followed.

So whether you are a client or may become one we want to make sure that the bases covered.

September 28, 2023

-

Medicare Part D Notifications Due

If you need a template let us know.

Must be distributed by October 15th.

Who should receive a notice?

-

Pay or Play: Employer Responsibility Cost Update

Applies if 50+ FT equivalent employees.

What is the new rate?

How can it be calculated?

-

Open Enrollment Checklist for Employees

What should you be reviewed?

What are the new considerations?

What to do if medical coverage is changing.

September 14, 2023

-

Health Plan Enrollment Rules

When can employees enroll?

What an open enrollment period?

What triggers a midyear enrollment?

-

Health Plans Infogragh

Great to place in breakroom.

How are plans different?

What Types of options are there?

-

Hiring Trends

How much has hiring decrease in early 2023?

How can employees be engaged?

How can tech help?

August 24, 2023

-

Accommodating for Disabilities

How to reasonably accommodate.

Implementing accommodations.

Download an ADA Checklist

-

Tracking Hours of Remote Workers

What are the best practices?

What if employees fail to report hours?

Can an assumption be made that work was done?

-

Open Enrollment is Around the Corner

Download a thorough checklist.

Know HSA/FSA limits.

Which notices must be given to employees?

August 17, 2023

-

Skills Gap Checklist

Not all employees can do everything well.

Where can improvement be made?

Great self-assessment tool as well.

-

Preventative Care Guidelines

You think you know them all?

Guidelines for well woman exams.

What are the 2023 updates?

-

ERISA Compliance

You can never know too much!

Are you required to file a 5500 too?

What should the ERISA Plan address?

July 27, 2023

-

New I-9 Forms

When are they available?

When to start using new form.

Where do I get the new I-9?

-

Fully vs. Self-Insured Compliance

What are the differences?

What compliance is needed for both?

A table to help.

-

Trained Supervisors, the Extra Layer of Protection

Where should they have extra training?

Why train them a little more?

What are the best practices?

July 13, 2023

-

What is the Max Waiting Period for FT Employees?

How long can the wait be?

Do the weekends count?

How are variable hours counted?

-

Workplace Wellness Compliance

What are the laws that oversee wellness?

Is the plan participatory or health-continent? It matters.

Understand how this can affect ADA regulations too.

-

PCORI Fees Due July 31st

ACA mandated fee.

Due only for self-insured plans.

Know what the fee is for 2022 PY filing.

June 22, 2023

-

Employer Obligated to Designate FMLA Leave

Must be designated w/in 5 days.

Employer may not delay designation.

Understand if PTO matters.

-

Creating Employee Surveys Right

Why have a survey?

What kind of survey should I have?

How should a survey be formatted?

-

Fireworks Safety

Great to post in breakroom.

6 easy tips.

Easy to follow precautions.

June 8, 2023

-

Mentor Employees with… Employees!

Encourage employees to learn from each other.

How can a mentoring program start?

94% of employees would stay if felt invested in.

-

Federal Employment Law Cheat Sheet

Which laws are everyone responsible to uphold?

Laws based on number of employees.

Hyperlinked resources for more help.

-

Get Buy-in on New HR Initiatives

Winning the stakeholders.

The steps to consider.

Have the successful outcome desired.

May 25, 2023

-

COBRA Compliance Checklist

Make sure you’re doing it right.

Step by step process.

Model forms link.

-

Employer Branding Checklist

How do people see your organization?

Mission, values and culture?

Recruiting and training employees.

-

Offboarding Checklist

Make sure there is knowledge transfer.

What information is important to pass along?

Who should help create the knowledge base?

May 11, 2023

-

$1,400,000,000 In ERISA Fines.

That’s how important an ERISA Document is!

Every Company offering benefits needs one.

Where can you get one? From us.

-

Summary of Benefits and Coverage

Every carrier has to use the same template.

High level view of the medical plan and coverages.

Employees need to have easy access.

-

Know the Rules for Employee Leave

FMLA, Military, ADA and state laws.

Tip to help understand the differences.

What are the compliance tips?

April 27, 2023

-

Checklist: Get I-9s Right

How to set up E-Verify.

What to do if it doesn’t match.

SSA or HHS Referrals processes.

-

Form 5500 Exceptions

How many employees are required?

What if my number fluctuate?

When is the due date?

-

FAQ: What Can FSA, HSA & HRA Pay For?

How about my gym membership?

Alcohol or drug abuse treatment?

Nutritional counseling?

April 13, 2023

-

Self-Insured Plans

Know the Pros & Cons.

Understand reinsurance.

PCORI fee Info.

-

FMLA

Which employees are covered?

Calculating if you have 50 employees.

Includes some “Joint” or “Integrated” employees.

-

Your next best hire may work for …. YOU!

Looking inhouse for the next candidate.

Need help finding employees other skills?

Do you have a strategy?

March 23, 2023

-

Preventative Care Info-graph

Great to hang in the breakroom.

What is preventative care?

List of care practices.

-

ERISA Wrap Documents

Required when benefits are offered.

Employers’ responsibility.

We can help you get one.

-

Direct Mangers & Mental Health

Greater impact than Doctors and Therapist.

Work stress affect whole life negatively.

Counseling services built into most health plans.

March 9,2023

-

EEO-1 Reporting

Only apples to 100+ employers.

Begin inputting date mid-July.

Typical deadline March 31st.

-

END of COVID!

Ends May 11, 2023.

Medical Plan coverage changes.

HIPAA special enrollment ends.

-

Employee Policy Reviews for ‘23

Pay Transparency laws

Employee Expense Reimbursement.

Remote & Hybrid Workers.

February 23,2023

-

Self-Insured? Listen Up.

PCORI Fee has adjusted up.

When is it due?

How is it calculated?

-

Consolidated Appropriations Act

What is the CAA and why is it important?

What is the purpose?

What has it changed for your Broker?

-

COBRA: Get a Refresher.

How does COBRA work?

Who is eligible?

How long are they eligible?

February 9,2023

-

Telehealth for HDHPs

Extension of benefits to 2025.

1st Dollar expense requirement waived.

Still eligible to contribute to HSA.

-

Medicare Part D Notification

Requirement for all medical plans.

Know when to file.

Know where to file.

-

Banning Non-Compete Agreements

FTC Looking to make changes.

Designed to increase competition.

Could rescind current NCAs

January 9, 2023

-

ACA Reporting Deadline info.

If you have medical benefits, take a look.

Know the deadlines.

Section 6055 info.

-

Small Business Bulletin

Strategies during a recession.

HR strategies.

Retaining & attracting employees.

-

FMLA Violations

FMLA can cause BIG issues.

See multiple real-world examples.

Most common mistakes

December 29, 2022.

-

EOY HR Checklist

Get all of your ducks are in a row.

Compliance, payroll & benefits.

General HR to-dos review.

-

ACA Checklist

Are you compliant with ACA?

HSA, FSA, HRA… all the letters!

All that you forgot is listed here too.

-

Safe-Harbor Compliance

What is 2023 safe-harbor?

How is it calculated?

Are there different ways to calculate it?

December 8, 2022.

-

HR Year End Checklist

Remember all the things you forget.

Compliance & payroll.

EOY Activities.

-

Use Benefits Better

Reminders for the Breakroom.

Utilize the health plan better.

5 Ways to reduce RX costs.

-

Workplace Harassment

Preventative ideas.

How to discipline

Policy ideas.

November 21, 2022.

-

90 Day Waiting Periods

Calculation for variable hours?

Cumulative hours calculated.

How to handle rehires.

-

What are the Compensation Trends?

Salary hikes and variable pay.

On Demand pay is growing.

Pay transparency and perks.

-

Onboard Employees Smoothly.

5 quick tips.

Can help prevent turnover.

Do you have an HR Platform?

November 7, 2022.

-

Open Enrollment Communication

Have a smooth enrollment.

How to keep it simple.

When should you start?

-

Make Sure Your Plans Are ACA Compliant.

Know the new HSA/ FSA annual max.

Is your employer an ALE? Different rules.

Do you comply with the affordability rules?

-

Medical Bill Errors

How often are bills in error?

How to counter these errors?

Pay attention to the coding.

October 24, 2022.

-

Time to Vote: How to Handle It.

See your state’s laws.

What are a few options to consider?

Are there hard, fast rules to follow?

-

What is Primary Care? Infograph.

Great for the breakroom.

Why is a PCP Important?

PCP interaction lowers costs.

-

HR Analytics.

How can you use them?

Make better decisions.

Leverage better info to make better decisions.

October 10, 2022.

-

TeleHealth Nondiscrimination Guidance

What steps need to be taken for compliance?

Are employees disabled or proficient with English?

Learn where to go to get the right information.

-

I-9 Checklist

Need to complete an internal audit?

Processes to verify information.

How should errors be corrected?

-

Quit Quitting…. It’s a Thing!

What does this mean?

Know these 5 signs.

How can it be prevented?

September 19, 2022.

-

How Should Employers Handle Medical Loss Ratio Rebates?

What allows a group to receive the rebate.

When would the rebate be received?

How can the rebate be used?

-

When can Employees Enroll in Benefits?

When is an Employee first eligible?

Can changes be made during the year?

What notices should a group be providing?

-

FMLA Checklist.

Do you have over 50 employees?

Do you need a notice poster?

Dot your I’s and cross your T’s.

September 5, 2022.

-

Do You Know Your Heath Plan?

Easy to read table of all plan types.

Which type of plans need referrals?

PPO, HMO, HSA, HRA… huh?

-

How Important Are I-9s? Super Important!

Take a look at the I-9 Toolkit.

What are the best practices?

What are common violations and penalties?

-

How can you save on Rx?

Average person spends $1200 a year.

Need a few strategies to save?

What should you be asking?

September 19, 2022.

-

How Should Employers Handle Medical Loss Ratio Rebates?

What allows a group to receive the rebate.

When would the rebate be received?

How can the rebate be used?

-

When can Employees Enroll in Benefits?

When is an Employee first eligible?

Can changes be made during the year?

What notices should a group be providing?

-

FMLA Checklist.

Do you have over 50 employees?

Do you need a notice poster?

Dot your I’s and cross your T’s.

AUGUST 22, 2022

-

Making Better Employees with Microlearning

Proven way to educate employees

What are the best methods?

What are typical means and costs?

-

When an Employee Leaves… A Checklist.

All the things you forget about listed.

Have a workflow for the process.

Maybe a few you haven’t considered.

-

Health Insurance Affordability Number Lowered.

New rate is the lowest ever.

Could increase employer contributions

Find out what the new number is.

AUGUST 11, 2022

-

Open Enrollment is Coming

Need a check list?

What are the new laws and regs?

Have a list of notices.

-

Affordability Penalty. Know about it.

What are the triggers?

What are the responsibility rules?

How are safe harbors determined?

-

New Nat’l Mental Health Hotline

Available 24/7.

Just like 911, but dial 988.

Focus on emotional distress and suicide.

July 25, 2022

-

Helping Employees with Student Loans

Cares Acts allows for $5,250 paid by employers.

Provision is an extension to 2025.

Did you know that Foundation Benefits has a Student Loans assistance program? Ask us.

-

Rx Price Transparency

50 most often dispensed prescriptions.

50 most costly prescriptions to the medical plan.

50 largest increases in prescription io the plan.

-

What are the Rules for Employee Leave?

Family Medical Leave Act

Uniformed Services Employment & Reemloyement Rights Act

American Disabilities Act

July 4, 2022

-

Active Shooter. Have a Plan

Over 50% at work and retail locatio ns

Learn preventative measures.

Create an Emergency Action Plan.

-

Productivity Tips for Hybrid Employees

Better Scheduling ideas.

What tech should be at the home office?

Communication ideas.

-

HSA Help

How much can be contributed

Are OTCs part of the plan?

Do networks play a role here too?

June 20, 2022

-

Helping Prevent Phone Scams

1 in 4 scammed lost money.

What are the warning signs?

What are the best steps to help avoid scams?

-

PCORI Fees are coming due August 1

Only effect self-insured plans.

Paid on every “belly button” on plan.

You will need Form 720. Attached.

-

Employee Handbooks. Really Important

Not having an employee handbook is risky.

It’s a guide that helps employers and employees.

It’s so important we will give a template.

June 6, 2022

-

A Few Tips About … Tips

DOL has new guidelines.

Tip pooling guide.

Can managers participate?

-

ACA Medical Parameters for 2023 Announced

Out of Pocket max increases.

Affordability measurement decreases.

Link to ACA factsheet.

-

FMLA and Mental Health… Need to Know

Mental health as a condition with FMLA.

FAQs included.

DOL fact sheet about mental health & FMLA.

May 23, 2022

-

Employees: Now you have them, how do you keep them?

33-page Employee retention Booklet

Strategies, incentives, checklist & surveys.

Everything that you need in a single place.

-

On-demand Pay: What You Need to Know.

What is on-demand pay?

Is it right for the company or employees?

How is it utilized and processed?

-

Emergency Room Care: Do you really need it?

What are the times that the ER is the right choice?

What is a more cost-effective treatment option?

Do employees know when to us ER?

May 12, 2022

-

Lots of Laws About Employees

Learn the laws that apply to all employers.

Many laws depend on employee count.

See list of the laws that apply to the company.

-

In the Loop Concerning Cyberattacks

10 ways to protect yourself.

Important to company & individual employees

Need help with solution? We have some.

-

You Never Know Enough About HIPAA

Keeping medical info secure is very important.

Guidance on how medical info can be used.

It’s serious… fines and jail time.

April 25, 2022

-

Summer Heat is Coming

OSHA heat hazard standards

If employees are outside, know what is expected.

What does OSHA recommend?

-

Keeping the Good Employees in Small Businesses.

What are your strategies?

How can you recruit better?

How can benefits help you?

-

Choosing the Right PCP

What is a PCP?

Network and needs are important.

Get referrals first.

April 11, 2022

-

Wellness Plan Compliance What You Need to Knows

Wellness plans can be out of compliance?

HIPAA, ADA and GINA Laws apply.

Is you plan Participatory or Health-Contingent?

-

Tips to Reduce Employees Healthcare Cost

What are the best methods?

4 Tips to give to employees.

Employee saving = employer saving at renewal

-

Cyberattacks: How HR Can Help Prevent Them

83% of breaches gained access to SS#s.

Cloud based systems are more vulnerable.

What should be in the response plan?

March 21, 2022

-

DOL Wage and Hour Case Studies

How to avoid DOL violations.

What can kick-off an audit?

Four short case studies.

-

DOL Focus on Warehouse and Logistics Employees

Focused on 1099 vs. W-2 misclassifications.

Addition of 100 DOL investigators.

Make sure to audit payrolls for accuracy

-

Non-US Employee Needing Help

Article focuses on International crisis.

Helpful for all non-US born employees.

Good reminder to HR of signs to looking for.

March 7, 2022

-

Healthcare Cost Transparency.

1.1.22 General care costs must be made public.

Out of pocket costs must be provided.

List cost and negotiated cost must be available.

-

Value a Learning Culture

Employees want to be invested in.

Personalize a learning plan.

Are candidates lifelong learners?

-

MHPAEA Enforcement

You don’t know what it is, but you need to!

Make sure that your medical plan is compliant.

Must be treated just like all medical issues.

February 21, 2022

-

Managing Chronic Conditions

Major costs to medical premiums.

40% of US has 2 or more.

Keep up with medications is important.

-

Sexual Harassment & Assault Claims

No longer to be settled by arbitration

Will go directly into effect once signed by Biden.

Arbitration in some cases will still be used.

-

Keep Up with Employer Annual Filings

Which filing are you required to file?

Does the number of my employees’ matter?

ACA, COBRA, ERISA, FMLA….

February 14, 2022

-

No Surprise Billing

• Went into effect 1.1.22

• Helps curb out of network costs

• A real win for insured employees

-

Employee Assistance Plans

• In most life and disability policies

• A benefit that more employees are using

• Mental, addictions & financial services.

-

5 HR Trends in 2022

• Labor shortage issues

• HR Technology

• Employee wellness and wellbeing .

Cafeteria Plans: Mid-year Election Changes

Participant elections under a Section 125 cafeteria plan must be made before the first day of the plan year or the date taxable benefits would currently be available, whichever comes first. Participant elections generally must be irrevocable until the beginning of the next plan year. However, Internal Revenue Service (IRS) regulations permit employers to design their cafeteria plans to allow employees to change their elections during the plan year, if certain conditions are met.

Recruiting for Soft Skills

There’s a lot more that goes into finding the right candidate for your company’s opening than just a block of text.

That’s why the interview process exists and why, as an HR professional, learning how to recognize soft skills is so important.

Supreme Court Rejects Challenge to Individual Mandate

On June 17, 2021, the U.S. Supreme Court rejected a lawsuit challenging the constitutionality of the Affordable Care Act’s (ACA) individual mandate in a 7-2 ruling. This lawsuit was filed in 2018 by 18 states as a result of the 2017 tax reform law that eliminated the individual mandate penalty.

Form I-9 and Your Employees

IRCA requires employers to hire and retain only individuals authorized to work in the United States, and imposes strict penalties on those that knowingly employ illegal aliens. To enforce these guidelines, IRCA requires employers to verify a potential employee’s eligibility to work in the United States by completing the Employment Eligibility Verification Form (Form I-9).

HSA/HDHP Limits Increase for 2022

On May 10, 2021, the IRS released Revenue Procedure 2021-25 to provide the inflation-adjusted limits for health savings accounts (HSAs) and high deductible health plans (HDHPs) for 2022.

These limits include:

• The maximum HSA contribution limit;

• The minimum deductible amount for HDHPs; and

• The maximum out-of-pocket expense limit for HDHPs.

Understanding Accident Insurance

Whether you suffer a concussion falling off a ladder or dislocate your shoulder moving the couch, injuries can lead to costly medical care, loss of work time and various other related expenses. If you don’t want to be caught financially unprepared to handle an accident, consider accident insurance.

Hire to Fit Your Company Culture

Poor hiring decisions can be extremely costly for your company, in terms of business interruption, wasted recruiting and training resources, lower employee morale and more.

Patient-Centered Outcomes Research Institute (PCORI) Fees

PCORI fees are reported and paid annually using IRS Form 720 (Quarterly Federal Excise Tax Return). These fees are due each year by July 31 of the year following the last day of the plan year. A federal spending bill enacted at the end of 2019 extended the PCORI fees for an additional 10 years. These fees will continue to apply for the 2020-2029 fiscal years.

Protecting HR Teams from Burnout

Burnout is a commonly discussed issue. Oftentimes, it’s HR’s responsibility to help employees cope with burnout and its contributing factors. In many cases, that leaves HR teams without lifelines of their own. However, HR professionals can take steps to stay afloat when feeling overburdened.

The Family and Medical Leave Act (FMLA)

The Family and Medical Leave Act (FMLA) is a federal law that provides eligible employees of covered employers with unpaid, job-protected leave for specified family and medical reasons. Under the FMLA, eligible employees may take leave for their own serious health conditions, for the serious health conditions of family members, to bond with newborns or newly adopted children or for certain military family reasons. In addition to providing eligible employees with an entitlement to leave, the FMLA requires that employers maintain employees’ health benefits during leave and restore employees to their same or equivalent job positions after leave ends.

Texas Employment Law - Workers' Compensation

Workers’ compensation is a system of no-fault insurance that provides monetary and medical benefits to employees, or their survivors, for work-related injuries. While participation in the Texas workers’ compensation system is optional, employers that choose to participate must comply with all provisions of the Texas Workers’ Compensation Act (TWCA). The TWCA defines employer responsibilities in the workers’ compensation program.

Comparison of Federal COBRA Requirements and Texas Continuation Laws

The Family and Medical Leave Act (FMLA) is a federal law that provides eligible employees of covered employers with unpaid, job-protected leave for specified family and medical reasons. Under the FMLA, eligible employees may take leave for their own serious health conditions, for the serious health conditions of family members, to bond with newborns or newly adopted children or for certain military family reasons.

PPE Expenses Are Reimbursable Under Health FSAs, HRAs and HSAs

The Internal Revenue Service (IRS) recently announced that amounts paid for personal protective equipment (PPE)—such as masks, hand sanitizer and sanitizing wipes—used for the primary purpose of preventing the spread of COVID-19 are deductible expenses for medical care.

DOL Issues ARPA COBRA Subsidy Model Notices, FAQs

On April 7, 2021, the Department of Labor (DOL) issued FAQs and model notices for the COBRA premium assistance provisions of the American Rescue Plan Act (ARPA). The ARPA provides a 100% subsidy for employer-sponsored group health coverage continued under COBRA and similar state continuation coverage programs for eligible individuals. The subsidy applies from April 1 through Sept. 30, 2021. The notices and the FAQs appear on a new DOL webpage dedicated to the ARPA COBRA subsidy.

The Importance of Accurate Job Descriptions

The Internal Revenue Service (IRS) recently announced that amounts paid for personal protective equipment (PPE)—such as masks, hand sanitizer and sanitizing wipes—used for the primary purpose of preventing the spread of COVID-19 are deductible expenses for medical care. Because these amounts are expenses for medical care, the amounts paid for PPE are also eligible to be paid or reimbursed under any of the following:

• Health flexible spending arrangements (FSAs)

• Archer medical savings accounts (Archer MSAs)

• Health reimbursement arrangements (HRAs)

• Health savings accounts (HSAs)

However, if an amount is paid or reimbursed under a Health FSA, Archer MSA, HRA, HSA or any other health plan, it will not be considered a deductible medical expense.

American Rescue Plan Act's Employment-Related Provisions

President Biden signed the American Rescue Plan Act of 2021 (ARPA) into law on March 11, 2021. The law generally provides financial relief for individuals, state and local governments, schools, businesses and for other purposes. In addition, the law contains the following measures of special interest to employers and their employees: A subsidy for COBRA premiums funded through employer tax credits, extension of employer tax credits for FFCRA employee leave voluntarily provided through Sept. 30, 2021, expansion of employee earnings eligible for the FFCRA tax credit, and inclusion of testing and immunization as reasons for FFCRA leave along with other provisions.

Health Plan Rules - Treating Employees Differently

Some employers may want to be selective and treat employees differently for purposes of group health plan benefits. In general, employers may treat employees differently, as long as they are not violating federal rules that prohibit discrimination in favor of highly compensated employees. These rules currently apply to self-insured health plans and arrangements that allow employees to pay their premiums on a pre-tax basis. The nondiscrimination requirements for fully insured health plans have been delayed indefinitely. Employers should also confirm that any health plan rules do not violate other federal laws that prohibit discrimination. In addition, employers with insured plans should confirm that carve-out designs comply with any minimum participation rules imposed by the carrier.

Understanding Patient Privacy and HIPAA

The trust that you place in your health care provider is critical to receiving high-quality care. However, with the emergence of electronic databases, you may be concerned that your information could be accessed by those other than your health care provider. Fortunately, the federal government developed standards for patient privacy as part of the Health Insurance Portability and Accountability Act of 1996 (HIPAA). It’s important to be familiar with the basic principles that govern the HIPAA privacy rules, such as the requirement that patients control the release of their medical information.

The Benefit of Benefits

Remaining competitive in the hunt for the right job candidates who will propel your business to success is a struggle. Once you find the people you need, you have to convince them that your company is a better place to work than your competitors. A strategic, quality benefits package can help you attract and retain those top employees. Employees value a well-rounded selection of benefits, and health insurance, a 401(k) plan, life insurance and dental coverage are a few of the plans that you can consider offering.

ACA Violations - Penalties and Excise Taxes

The Affordable Care Act (ACA) includes numerous reforms for group health plans and creates new compliance obligations for employers and health plan sponsors. The ACA, for example, requires health plans to eliminate preexisting condition exclusions and provide coverage for preventive care services without cost-sharing. Some of the reforms for health plans apply to all health plans, while others apply only to non-grandfathered plans or to insured plans in the small group market. Failing to comply with the ACA’s requirements can cause severe consequences for an employer. The potential consequences vary depending on the ACA requirement that is involved and the nature and extent of the violation. Employers should keep these consequences in mind as they continue to work on ACA compliance.